Mobile Notary in Alexandria, VA

The Doc Preparer provides professional mobile notary service across Alexandria and Northern Virginia. We come to your home, office, hospital, or facility to notarize documents efficiently and correctly—so you can meet deadlines with less stress. If you need an affidavit notarized, a power of attorney signed, a school or travel form completed, or business paperwork notarized, we make booking simple and the appointment smooth.

Clear expectations

We confirm location, timing, ID requirements, and pricing before we arrive.

Convenient travel

Home, office, café, hospital, or facility—choose what works best for you.

Professional process

Identity verification, signer awareness, and accurate certificate completion.

Most-requested notarizations

-

Affidavits & sworn statements

-

Power of attorney

-

School and travel consent forms

-

Business documents and authorizations

-

Facility signings (hospitals, nursing homes

Bring your unsigned documents and a valid photo ID for each signer. If witnesses may be required, mention it when you book.

Convenient notarization, built for real life

Mobile service is ideal for busy schedules and tight deadlines.

We confirm location, timing, ID requirements, and pricing before we arrive.

Clear communication and a respectful, calm appointment experience

We travel throughout Alexandria and nearby Northern Virginia areas.

What we notarize Common documents requested in Alexandria and Northern Virginia.

Personal documents

Mobile notarization makes personal paperwork easier—especially when time is limited. We commonly notarize travel consent forms, school forms, identity statements, sworn affidavits, and other personal documents that require verified signatures.

-

Travel consent & school forms

-

Affidavits and sworn statements

-

General personal notarizations

Power of attorney & authorizations

Power of attorney documents are often time-sensitive. We keep the signing process focused: verify ID, confirm willingness/awareness, and complete the notarial act accurately. If witnesses are required, we plan for that before arrival.

-

Power of attorney (POA)

-

Authorization letters

-

Healthcare-related authorizations

Business documents

Businesses often need notarizations for banking, vendor onboarding, internal governance, and contracting. Mobile service helps keep operations moving—especially when multiple signers are involved.

-

Business agreements and authorizations

-

Corporate resolutions and statements

-

Bank and vendor forms requiring notarization

Multiple signers & multiple documents

If you have several people signing or more than one document, we can handle it in one visit. We’ll confirm the number of signers and notarizations up front so you get an accurate quote and smooth scheduling.

-

Two+ signers in one appointment

-

Multiple notarizations

-

Organized signing flow

Out-of-state documents used in Virginia

Many documents are drafted for another state but signed in Virginia. We can often notarize these as long as the notarization is performed under Virginia rules and the certificate can be completed properly.

-

Out-of-state documents signed in Virginia

-

Certificate wording confirmation

-

Fast appointment planning

Facility signings

Hospitals, nursing homes, and assisted living facilities require extra planning. We coordinate timing, access requirements, and signer readiness to keep the appointment respectful and efficient.

-

Hospitals and rehab centers

-

Assisted living & nursing homes

-

Family coordination for signers

Notary scope and important notice

Notarization verifies identity, willingness, and signer awareness, and completes the official notarial certificate. We are not attorneys and do not provide legal advice. If you need help deciding what document to use or how to complete it, consult a qualified attorney. We can explain what to bring and how the notarization process works.

How it works

Most notarization delays come from missing ID, signing too early, or surprise witness requirements. Our booking flow is designed to avoid that.

1) Schedule

Book online or call/text. Share your location, preferred time window, number of signers, and number of notarizations.

3) We travel to you

We meet at your chosen location in Alexandria or nearby Northern Virginia areas and set up for a clean, efficient signing.

2) Confirm details

We confirm ID requirements, timing, and pricing. If witnesses may be needed, we coordinate in advance.

4) Notarize and Finish

We verify ID, confirm willingness/awareness, and complete the notarial act. You leave with properly notarized documents.

Quick checklist before the appointment

-

Keep documents unsigned unless your instructions explicitly say otherwise.

-

Have a valid government-issued photo ID ready for each signer.

-

Bring all pages of the document, including any notarial certificate pages.

-

Confirm witness requirements before booking.

-

Choose a well-lit, quiet signing spot with a solid surface.

Pricing (simple and upfront)

Mobile notary pricing generally includes the notarization fee(s) plus a travel/convenience fee based on distance, timing, and urgency. We confirm pricing before the appointment begins so you know what to expect.

What affects your total

-

Location: travel distance within Alexandria and nearby areas.

-

Timing: evenings, weekends, and urgent requests.

-

Complexity: number of signers and notarizations, and witness coordination.

-

Waiting time: extended delays if signers are not ready at the appointment time.

Upfront confirmation

We confirm your expected total before arrival. If anything changes during the appointment (additional notarizations, extra signers, or extended waiting), we discuss it before proceeding.

Get a quick quote

Send these details by text for the fastest confirmation.

-

Location (address or neighborhood)

-

Date/time window

-

Number of signers

-

Number of notarizations

-

Any witness requirement

Rescheduling

If you need to reschedule, the sooner you reach out the easier it is to secure a new time window—especially for evening or weekend availability.

Why clients choose The Doc Preparer Reliable, convenient, and handled with care.

We make it simple

We ask the right questions up front, arrive prepared, and complete the notarization accurately—without turning it into a complicated process.

We respect your time

Mobile service exists to save time. Clear confirmation prevents the most common issues that cause repeat visits or delays.

We’re local to Alexandria

Knowing the area helps with realistic scheduling and efficient travel—especially for urgent, same-day requests.

We build trust

Notarization is a trust-based service. We prioritize identity verification, signer awareness, and accurate completion of the notarial act.

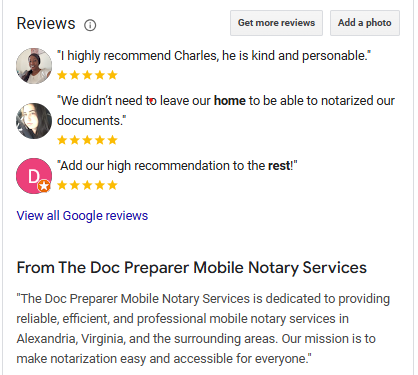

What clients say

Service areas

We serve Alexandria and surrounding Northern Virginia communities. If you’re nearby and unsure whether we cover your location, call or text and we’ll confirm.

Primary areas

Alexandria • Arlington • Fairfax • Springfield • Falls Church • Annandale

Frequently asked questions Clear answers that help you book with confidence.

What do I need to bring for notarization?

Bring a valid government-issued photo ID for each signer and the unsigned document(s). Make sure you have all pages, including any notarial certificate pages.

Do you offer same-day mobile notary appointments in Alexandria?

Same-day appointments are sometimes available depending on schedule and location. Call or text for the fastest confirmation.

How much does a mobile notary cost?

Pricing typically includes notarization fee(s) plus a travel/convenience fee. Travel fees vary by distance and time. We confirm pricing before the appointment.

Should I sign my document before the appointment?

Usually no. Many documents must be signed in the notary’s presence. Keep the document unsigned unless your instructions explicitly say otherwise.

What if my document needs witnesses?

Some documents require witnesses in addition to notarization. Tell us in advance so we can coordinate and schedule appropriately. If you’re unsure whether witnesses are required, check with the document provider or an attorney.

Can you notarize at a hospital or nursing home?

Yes. We notarize at hospitals and care facilities when permitted. We coordinate timing and access requirements with you before arrival.

Can you notarize for multiple signers in one appointment?

Yes. Each signer must be present with valid ID and must be willing and aware. We can handle multiple documents in one visit.

Do you notarize out-of-state documents while I’m in Virginia?

Often yes. The notarization must comply with Virginia notarial rules and the notarial certificate must be completed correctly.

How long does a typical appointment take?

Many appointments take 5–20 minutes, depending on the number of notarizations and signers. Facility signings or witness requirements may take longer.

Do you provide legal advice or help fill out forms?

No. We are not attorneys and cannot provide legal advice. We can explain the notarization process, ID requirements, and how to prepare for a smooth signing.

Can we meet at my workplace or a public location?

Yes, as long as the location supports a clear signing process and signers can present valid ID. Quiet, well-lit spaces are best.

What’s the fastest way to book?

Text your location, preferred time window, number of signers, number of notarizations, and whether witnesses may be needed. Then we confirm availability and pricing.

Mobile notary in Alexandria: what to expect

Many people search for a mobile notary because they’re facing a deadline or they can’t easily travel to a storefront. Mobile notary service removes the need to drive across town, wait in line, and hope someone is available. Instead, you choose a convenient time and location, and the notary meets you there.

A notarization is a formal process that helps reduce fraud by verifying identity and confirming that the signer is signing willingly and with awareness. Notaries do not verify the truth of the document’s content and do not decide whether your document is the “right” one for your situation. For questions about what document to use or how to fill it out, consult a qualified attorney.

Common reasons people need a mobile notary

-

Travel consent forms for minors and school forms

-

Affidavits for insurance, claims, and identity verification

-

Power of attorney and authorization documents

-

Business documents for banking, contracts, and vendor onboarding

-

Facility signings for hospitals and nursing homes

How to prepare for a smooth appointment

Preparation is simple: have your ID ready, keep documents unsigned, confirm witness requirements, and choose a quiet, well-lit location. If your document has special instructions, keep them available during the signing.

If you’re unsure what you need, call or text and we’ll explain the notarization process and what to bring. We focus on making the experience professional and efficient so you can move forward confidently.

Appointment message you can copy

Hi, I need a mobile notary in Alexandria. My location is: __________. I’d like to book for: __________. There are ___ signer(s) and ___ notarization(s). Witnesses needed: Yes / No / Not sure.

Contact

Phone/Text: (571) 565-7073

Serving: Alexandria, VA & Northern Virginia

Quick booking details

-

Your location (address or neighborhood)

-

Preferred date/time window

-

Number of signers

-

Number of notarizations

-

Witness requirements (if any)

Notary services verify identity and complete notarial acts. We are not attorneys and do not provide legal advice.

Notice to Clients: Acceptance of Terms

By reading this notice and choosing to engage our services, you agree to the terms outlined below, including fees and policies. Your decision to proceed constitutes acceptance of these terms.

Notary Fees in Virginia

In Virginia, notaries are authorized to charge up to $5.00 per notarial act. Additionally, notaries may charge for actual travel expenses incurred when traveling to a client’s location, provided both parties agree to the payment in advance. Upon engaging our services, you acknowledge and accept these terms.

Travel Fees

Travel fees are calculated based on the distance from the notary's base location in Alexandria, VA, using the most direct route. Fees will be disclosed and agreed upon prior to the appointment.

Note: All fees are subject to change. Clients will be notified of any changes in advance of their scheduled appointment.

For services beyond the listed areas or for specialized requests, please contact us directly to receive a customized quote tailored to your needs.

Transparency and Compliance

This fee schedule is designed to ensure clarity and transparency for all clients utilizing our mobile notary services in Alexandria, Arlington, and the greater Northern Virginia area. All services are conducted in full compliance with Virginia state laws and regulations.

Thank you for choosing our services. By proceeding, you confirm your agreement with these terms.